If you like what you are about to read please be sure to leave a comment below.

We have all heard the familiar expression made famous by Capital One “What’s in Your Wallet” but is that what they really mean? I mean, don’t they really mean “What credit card are you using” because that’s what the commercial suggests. We’ll leave that notion right where it is with no further comment because there’s a bigger question; “What is Your Blockchain” or do you even have one? Should you have one? Let’s take a look and see.

Japan – On April 1, 2017, a new Law went into effect in Japan. The Japanese National Diet (Japan’s legislature) recognized cryptocurrency as a legitimate (ergo, Legal) form of accepted payment. So why does this matter?

It matters because the Japanese Yen is the second most liquid form of used currency in the world, the 2020 Olympic Games are held there and this new Japanese Law will increase the number of Japanese Retailers that accept Bitcoin from 5,000 to around 250,000! Yes, 250,000 and when this happens you can be sure that it has at that moment gone viral.

And this is not even counting China which has already now become an “SDR” or “World Reserve Currency” and they are wasting no time creating their own Gold Exchange (nope, not paper trade gold, real Bullion) and are also increasingly accepting Bitcoin and other Blockchain currencies. They are also buying up, producing more and now hold more Gold than any other nation on earth!

The Facts – Look, it’s no secret that there has been a war on cash for several years now. If you don’t believe me then go down to your local familiar bank and ask to withdraw $4,000. The number used to be that any $5,000 withdrawal by an individual prompted by law for the Central Bank to file what we call a SAR or “Suspicious Activity Report”. What, suspicious? Yep, that right it did not matter how well the bank knew you or your business it was the law. Now the law requires a SAR to be reported on ANY amount if the bank teller believes that “it may be” used for an illegal activity and some have been filed with as little amounts as $300. This is both absurd and insane but let’s back up a moment and think.

What is Your Bank Account – Well, 20 years ago it represented an amount of cash at least of which 10% of the total deposited amount was held in that very Bank overnight, every night. Today your Bank account is already a “cryptocurrency” in actuality because it is a digital numeric allocation of an amount in an electronic database, nothing more only the Central Bank Has possession of this digital ledger. All Blockchain and Bitcoin does is take this digital ledger out of the hands of a Central Bank and places it in the hands of an Electronic Digital entity that 1) cannot go broke because only assets can be held there 2) will not be gambled on risky investments as the central banks have done over and over in the last decade (remember the Bank Bailout?) and 3) is there whenever you want it, it doesn’t matter the amount, no questions asked and no SAR. And what about those ever so familiar exorbitant fees and commissions to exchange currency? Nope, not there either. Gone. It is anonymous so if you want to spend or give away a sum of money then you may do this with total anonymity. I like that! Ah… at last, some Privacy.

What Cryptocurrency is – It’s a D-I-V-O-R-C-E from the US Central Banking system, or in “Cyber-technological terminology” terms it’s a “Mega-Disruption” in the Central Banking System. It removes the Central Bank that charges fees for just about everything from the entire transaction. No more NSF or “overdraft” fees. Did you know that there is a new Bill in effect in the US that has been paraphrased as a “Bail-In” law? Well, there is and as one might guess it was passed in the waning hours of the US Congressional session before a break when the media was not paying too much attention. It will pass into Official Law or be ‘actionable’ under Executive Order.

This means that in a time of emergency the US, upon Executive Order may seize a part or all of your accounts in any Federal Reserve protected Bank (virtually all of them) and woefully this includes the Bank’s Lockboxes so it would no longer do you any good to store cash in a FDIC Banking institution. (3.) Would the United States do this? Let me ask you a simple question, what do you think?

1933 – “The Bank Holiday” – Know to anyone that was around in 1933 when there was a “Bank Holiday” or ever heard your grandparents speak of it? Well I have, I grew up with my grandparents, born in 1900 and were parents of nine children in 1933 and I heard it every day about how they had wished they had not turned in all their gold coins and that none of the Bankers in the town turned in theirs and they prospered handsomely. So, you also do not run the risk of a “Crypto-Currency Holiday” – Can’t Happen, in fact, your cryptocurrency would without a doubt be worth MORE if the “Bail-In” Executive Order were ever issued.

IS THIS A FAD LIKE THE “DOT COM” BUBBLE?

Let me give you the short answer – NO, for several reasons. One – It has the major players in the game for the first time. Two – There are so many economic catastrophes that can affect a Central Banking system that is simply by technological capabilities impervious to Cryptocurrencies but let’s make one point clear here once again. There are over 400 different Cryptocurrencies out there today and some of them are very new and there are stories and sales pitches where it features some high school kid who turned $100 into $20,000 in a week and for the most part some of these stories are true but they weren’t on the most widely used for which you should again refer to the Palm Beach Letter by Doug Casey who has been shouting this to the rooftops for almost three (3) years now.

Cryptocurrencies like NEM, DASH, Crypto-Jackpot, NEXUS, PASCAL COIN, QUARK, the list goes on and on and it is a sure thing that some investors are going to be Millionaires beyond their dreams but there are also some possibilities because of some unknown “glitch” that there could be some great loses. So, stay with the proven ones, the winners, the ones that the Major Retailers (and now Japanese Government) widely and gladly accept unless you are a frequenter of “GA” (Gambler’s Anonymous).

LOOK, HERE’S THE IMPORTANT THING TO REMEMBER

You have to decide whether you want to get into Cryptocurrencies to “preserve” and diversify your assets or do you want to gamble? Remember the old saying “If you let e man sell you a diamond ring for ten cents then chances are what you have isn’t worth a dime”. There is actually $30 Trillion in actual cash in the world today and there is $900 Trillion in Digital Currency. Big companies like Dish, Apple, Target, Victoria’s Secret, Whole Foods, Home Depot, CVS, Sears, and Amazon actually accept bitcoin as payment just as they would Visa, PayPal, or MasterCard.

CRYPTOCURRENCY IS BEING ATTACKED

Even now in the US Congress, there is another Bill that seeks to require “alternative payment methods” to report to the Federal Reserve. Now, this Bill could have dramatic ramifications and even go so far as to mean anything “Prepaid” such as Amazon cards, Wal-Mart or even Chuck-E-Cheese’s cards. This is the very epitome of ‘Draconian’ tactics. Take a look at the bill and see what you think, it’s listed in the footnote (4.), below. It’s called the “Combating Money Laundering, Terrorist Financing, and Counterfeiting Act of 2017.”

I can assure you that this new so-called “Bill” has nothing to do with fighting terrorism but it DOES have Everything to do with control. The media is publishing “fake news” denouncing Cryptocurrency then the very entities that own them tries to drive the price down so they themselves can buy them! The sad part for the Central Bankers and all of the Gold manipulation prosecutions that are going on against them happened because they had Control. Not so easy this time Central Bankers, you don’t control it!

Now, I am not saying that you should rush right in where “Angels Fear to Tread” and put all of your money into cryptocurrency because there are numerous so-called “brands” of cryptocurrency, Bitcoin and Blockchain being by far the most popular and has been running for years now without a “glitch” and becoming more widely accepted every day and do not think for a moment that the US Government has not attempted to “crack” the crypto code because they have but they have not been successful.

But what I am saying is that “yes” by all means place some of your assets in cryptocurrency and think of it as a divesting of assets, much like buying precious metals (which by the way is at an all-time high) and by all means learn more about it. In lieu of the new Senate Bill listed in footnote (4.). It may give you, even more, cause to think about divestiture of your portfolio of assets. The Banks and their interest, NSF, three-day processing, and fees are over! You are already in the digital world so why don’t you be safely in it rather than risk a “Bail-In” on a Central Bank’s Bad investments? The Central Banks in less than three (3) years will be about as outdated as a “Rotary Phone” (seen one of these on sale lately?)

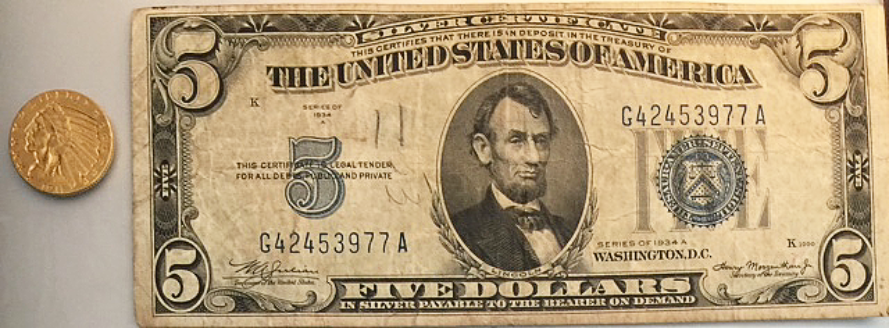

And as for my Grandfather’s advice so long ago in 1980, he left me with two forms of 1933 currency; a $5 Dollar Paperback Dollar Bill, the other a 1911 $5 Dollar Gold Coin with the advice “If you have to give up one of them, keep the Gold”.

AN INTERESTING COMMENT THAT WAS SPOKEN JUST DAYS AGO

Brian Kelly, the founder and managing member of Brian Kelly Capital Management (BKCM), shared a similar sentiment at the conference:

Six months ago, we started getting interest from family offices. Now we’re getting interest from venture capitalists and smaller institutions. And I think in three to five years, we’ll be getting interest from pension funds. We are still in the first innings. I would use any price pullback to buy; there is a wall of money coming. Just 1% of institutional money and we would see an explosion of prices.

This supports what Greg Wilson (5.). of The Palm Beach Letter explained in the March 27 Palm Beach Daily. There’s $3 trillion in assets under management in the hedge fund industry alone. If a small percentage of those funds goes toward bitcoin, it could boost prices to over $4,000 from the $2,300 as it stands today.

OK, you get the idea, get educated the easy way (see below) and let me leave you with some wise parting words from a very familiar American:

Thomas Jefferson said in 1802:

“I believe that banking institutions are more dangerous to our liberties than standing armies. If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around the banks will deprive the people of all property – until their children wake-up homeless on the continent their fathers conquered.” ©

1. If you really want to know more in-depth information and to decide if Bitcoin / Blockchain is right for you are now there are some excellent seminars and some Q & A sessions on Doug Casey’s The Palm Beach Letter where his expert colleague Teeka Tiwari assists in educating the before unaware of the newness of this new form of currency and may indeed ease some apprehensions or tensions you may have formerly had. It’s not as complicated as you think.

2. Simon Black, “Sovereign Man,” another rather satiric but yet credible source on cryptocurrency.

3. , “Bail-out Is Out, Bail-in Is In: Time for Some Publicly Owned Banks,” The Huffington Post.

4. IN THE SENATE OF THE UNITED STATES. May 25, 2017, Mr. Grassley (for himself, Mrs. Feinstein, Mr. Cornyn, and Mr. Whitehouse) introduced the following bill; which was read twice and referred to the Committee on the Judiciary.

5. Greg Wilson, “Why You Should Ignore the Media and Buy Bitcoin,” CaseyResearch, June 15th.

* Disclaimer – © 2017 Precocious Life. All rights reserved. Any reproduction, copying, or redistribution, in whole or in part, is prohibited without written permission from the publisher.

The information contained herein is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. It is not designed to meet your personal situation—we are not financial advisors nor do we give personalized advice. Cryptocurrency is a new & novel concept and like anything else within these parameters it has had and possibly will have volatility, like stocks, precious metals, etc… The opinions expressed herein are those of the publisher and are subject to change without notice. It may become outdated and there is no obligation to update any such information.

There should be nothing contained herein that should be construed as a recommendation. Any publications should be made only after consulting with your advisora and only after reviewing the prospectus or financial statements of the company in question. You shouldn’t make any decision based solely on what you read here.

Precocious Life writers and publications do not take compensation in any form for covering those securities or commodities. Precocious Life expressly forbids its writers from owning or having an interest in any security that they recommend to their readers.